Métaprogrammes : l’interdisciplinarité pour relever nos défis

Les métaprogrammes constituent un dispositif d’animation et de programmation scientifique sur un nombre restreint de sujets nécessitant des approches systémiques et interdisciplinaires pour répondre à nos défis scientifiques et sociétaux.

L’ambition des métaprogrammes est ainsi de :

- développer une recherche interdisciplinaire, et repousser les frontières de la science pour répondre aux grands enjeux sociétaux et/ou scientifiques;

- construire de nouvelles communautés scientifiques et les accompagner sur ces sujets ;

- accroitre la visibilité des recherches de l’institut aux niveaux national, européen et international et développer leur impact.

Par exemple, l’un de nos métaprogrammes, Holoflux, permet d’étudier ce que nous n’avons jamais étudié en tant que tel : l’ensemble formé par un individu - animal, humain ou plante - et les microorganismes qui vivent avec lui. L’objectif est de comprendre les relations entre l’hôte et ses microorganismes et leurs effets, par exemple sur la santé de l’hôte.

Chaque métaprogramme se base sur un document fondateur fixant les orientations scientifiques. Il est validé et suivi par le collège de direction d’INRAE et présenté au conseil scientifique de l’institut. Durant 5 à 8 années, le soutien financier alloué par INRAE permet de développer des actions interdisciplinaires comme des animations scientifiques, la constitution de réseaux scientifiques, ainsi que la conduite de projets de recherche interdisciplinaires et le financement de thèses.

Une première génération de métaprogrammes a été initiée par l’Inra en 2010. Un partage avec nos pairs au niveau international a été organisé en 2018. Les enseignements qui en ont été tirés, ainsi que les orientations stratégiques d’Irstea, et les prospectives interdisciplinaires réalisées conjointement par les scientifiques de l’Inra et d’Irstea en 2018-19, ont permis de définir une nouvelle génération de dix métaprogrammes, lancés par INRAE à partir de 2019.

Six prospectives scientifiques interdisciplinaires ont permis d’anticiper les besoins de recherche du nouvel Institut et de nourrir son projet global d’établissement. Elles apportent un éclairage sur les futurs fronts de science, enrichissent les choix d’orientation et de développement des partenariats qu’ils soient scientifiques, socio-économiques ou de formation.

La dynamique des métaprogrammes s’accompagne d’actions transversales (séminaires, école chercheurs) visant à soutenir et accompagner le développement des approches inter- et transdisciplinaires au sein de l’Institut.

La dynamique de lancement des métaprogrammes de 2nde génération depuis 2019 :

- HOLOFLUX : Holobiontes et flux microbiens au sein des systèmes agri-alimentaires (2019)

- SANBA : Santé et bien-être des animaux en élevage (2019)

- METABIO : Changement d’échelle de l’agriculture biologique (2019)

- SuMCrop : Gestion durable de la santé des plantes (2020)

- BETTER : Bioéconomie pour les territoires urbains (2020)

- BIOSEFAIR : Biodiversité et services écosystémiques (2021)

- SYALSA : Systèmes alimentaires et santé humaine (2021)

- DIGIT-BIO : Biologie numérique pour explorer et prédire le vivant (2021)

- CLIMAE : Agriculture et forêt face au changement climatique : adaptation et atténuation (2021)

- XRISQUES : Représentation, analyse et gestion des risques et incertitudes multiples pour les systèmes alimentaires, les agroécosystèmes et les populations (2022).

HOLOFLUX : Holobiontes et flux microbiens au sein des systèmes agri-alimentaires

Ce métaprogramme s’intéresse aux holobiontes, autrement dit l’ensemble formé par un hôte - humain, animal ou plante - et les communautés microbiennes qui vivent avec lui (les microbiotes). De la fourche à la fourchette, les systèmes agri‐alimentaires incluent et brassent une grande diversité d’holobiontes (plantes potagères, grandes cultures, arbres fruitiers, animaux d’élevage, producteur, agriculteur, consommateur...) et d’écosystèmes (élevages, fromageries, champs...). Cet ensemble de communautés microbiennes est dynamique, sous l’action des flux microbiens les traversant. HOLOFLUX étudie à la fois les holobiontes et les flux microbiens au sein des systèmes agri‐alimentaires, en allant jusqu’au pilotage des microorganismes au sein de ces systèmes. Il s’intéresse tout particulièrement aux enjeux d’une alimentation durable - performance et efficacité du système alimentaire, circuits courts, réduction des gaz à effet de serre, maintien de la biodiversité... - et à la préservation de la santé des plantes, animale et humaine : réduction des intrants, antibiotiques, pesticides, utilisation des microbiotes pour lutter contre les pathogènes...

Démarré en 2019, HOLOFLUX s’inscrit dans la dynamique du métaprogramme Inra « Méta-omiques et écosystèmes microbiens » (MEM) et mobilise les réflexions de la prospective scientifique interdisciplinaire « Approches prédictives pour la biologie et l’écologie »

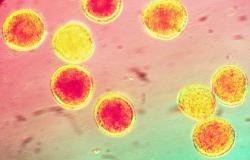

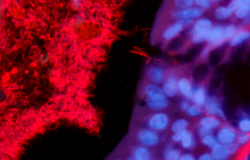

Humains, animaux, plantes, nous sommes tous des holobiontes. Le concept d’holobionte nourrit des travaux scientifiques de plus en plus nombreux.

SANBA : Santé et bien-être des animaux en élevage

La santé et le bien-être des animaux ont longtemps été envisagés au seul prisme de la mise en place de normes techniques et de dispositifs de prévention des maladies (mesures de biosécurité, vaccination, hygiène générale). L’enjeu actuel est de changer de paradigme en considérant désormais la santé animale, le bien-être des animaux et des hommes, comme des éléments cardinaux dans la conception des systèmes d’élevage. Dans cette optique, l’objectif de SANBA est de produire des connaissances qui permettront de faire évoluer les pratiques d’élevage et les systèmes de production, à l’échelle de l’animal, du troupeau, de l’exploitation, du territoire et des filières, de manière à garantir conjointement le bien-être et la santé des animaux tout au long de leur vie, de la naissance à l’abattage, tout en respectant la santé et le bien-être humains.

Etudier le bien-être des animaux d’élevage nécessite de s’intéresser au comportement des animaux, mais aussi, de manière plus globale, aux systèmes d’élevage et aux filières dans leur ensemble, en amont et en aval des exploitations d’élevage, jusqu’au comportement des consommateurs.

Démarré en 2019, SANBA s’inscrit dans la dynamique du métaprogramme Inra « Gestion intégrée de la santé des animaux » (GISA) et mobilise les réflexions de la prospective scientifique interdisciplinaire « Science pour les élevages de demain »

METABIO : Changement d’échelle de l’agriculture biologique

Et si l'offre nationale de produits bio devenait majoritaire ? Ce métaprogramme étudie les enjeux, les leviers et les conséquences qu’aurait ce changement radical et à grande échelle d’un système agri-alimentaire. Le « système » inclut production, conservation, transformation, consommation et les politiques publiques pour en appréhender les interactions. L’objectif est d’élaborer des propositions, scientifiquement étayées, pour favoriser et accompagner le déploiement des systèmes agri-alimentaires fondés sur l’agriculture biologique. Il s’agit également d’anticiper les conséquences du changement d'échelle dans un contexte de forte demande et d’évolution concomitante des systèmes de production conventionnels vers des modèles plus agroécologiques.

La bio est sortie d'une situation de niche et son extension suscite de nouvelles questions économiques, techniques, sociologiques... Comment accompagner et favoriser ce développement ? Des questions qu'explore INRAE.

Démarré en 2019, METABIO s’inscrit dans la dynamique du programme de recherches Inra « sur et pour l’agriculture biologique » (AGRIBIO). Il mobilise les réflexions des prospectives scientifiques interdisciplinaires « Agroécologie » et « Science pour les élevages de demain»

SuMCrop : Gestion durable de la santé des plantes

Comment produire en évitant ou en limitant le recours aux pesticides de synthèse ? Pour gérer durablement la santé des plantes, il faut à la fois de réduire les pertes de récoltes engendrées par les nombreux ravageurs et parasites des cultures, éviter les dommages à l’environnement et s’appuyer sur les solutions qu’il peut offrir, et bien sûr mettre en place des solutions viables pour les agriculteurs et la santé de tous. SuMCrop s’intéresse plus particulièrement aux solutions apportées par le biocontrôle et par la valorisation de l’immunité végétale. L’action du métaprogramme s’articule autour de trois grands leviers qui sont la diversification, la reconception des systèmes, et la transition vers des systèmes plus durables. Elle concerne à la fois la gestion des bioagresseurs indigènes et la réponse aux crises sanitaires déclenchées par des organismes invasifs. Dans ce dernier cas, les travaux interdisciplinaires sur la vulnérabilité des paysages agricoles sont par exemple fondamentaux pour développer une prophylaxie préventive mais aussi pour minimiser les dégâts en cas d’échec de l’éradication. Ces travaux s’étendent jusqu’aux sciences sociales, avec l’organisation de acteurs et la mise en place de démarches participatives.

SumCrop vient également en appui de projets soutenus par le programme prioritaire de recherche « Produire et Cultiver Autrement ».

Démarré en 2020, SumCrop s’inscrit dans la continuité du métaprogramme Inra « Gestion intégrée de la santé des cultures » (SMaCH).

BETTER : Bioéconomie pour les territoires urbains

Parce qu’il sera essentiel de pouvoir répondre demain aux enjeux de l’urbanisation croissante, le métaprogramme BETTER a pour ambition d’étudier en quoi le déploiement de la bioéconomie, au sein des villes et entre villes et campagnes, peut contribuer à rendre les villes plus durables. Il explore en particulier les évolutions socio-économiques, organisationnelles, structurelles et technologiques qui peuvent amener les villes à réduire leurs déchets, à mieux les recycler et les valoriser, et à diminuer leur consommation directe et indirecte de carbone fossile. La perspective est triple : tendre vers le zéro émission nette de carbone à l’horizon 2050, objectifs que se sont auto-assignés déjà un certain nombre de villes en France (dont Paris) et dans le monde, contribuer aux Objectifs du Développement Durable, et être plus résilientes face aux chocs et aux crises. BETTER est centré sur les besoins et les contraintes des territoires urbains mais s’attache particulièrement aux défis que la transition bioéconomique des villes pose à leurs territoires d’impact et d’influence. Il s’intéresse à leurs aires d’approvisionnement et d’assimilation, certaines se situant dans leur périmètre péri-urbain, d’autres étant éloignées et fragmentées à l’échelle mondiale.

Démarré en 2020, BETTER mobilise les réflexions de la prospective scientifique interdisciplinaire « Bioéconomie »

Se développer en harmonie avec son environnement plutôt qu’à ses dépens : un défi pour les villes qu’une économie plus frugale, fondée sur l’utilisation durable des ressources du vivant et la valorisation des déchets organiques peut aider à relever.

BIOSEFAIR : Biodiversité et services écosystémiques

Les travaux de l’IPBES (Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services) font un constat alarmant sur l’état de la biodiversité et des services écosystémiques. Cette dégradation de la biodiversité menace un grand nombre d’activités humaines, dont les systèmes agri-alimentaires, comme l’a rappelé la FAO (Organisation mondiale pour l’alimentation et l’agriculture) en 2019. Dans ce contexte de changements globaux, le métaprogramme Biosefair vise à répondre à un double enjeu : la gestion durable de services et fonctions assurés par les écosystèmes (nourriciers, régulateurs ou socioculturels) ; et la conservation et la restauration de l’ensemble de la biodiversité, à la fois pour entretenir les services qu’elle rend et pour ses valeurs intrinsèques. Biosefair étudie un large spectre de services tels que la contribution à l’atténuation du changement climatique, à la pollinisation, à la protection des cultures, la prévention des risques naturels ou encore les services culturels. Ce métaprogramme marque une évolution dans la façon de prendre en compte cette diversité de services en privilégiant une approche centrée sur les socio-écosystèmes constitués autour des milieux agricoles, systèmes d’élevage, milieux forestiers et aquatiques continentaux.

Lancé en 2021, Biosefair s’inscrit dans dynamique du métaprogramme Inra « Services rendus par les écosystèmes » (EcoServ) et mobilise les réflexions de la prospective scientifique interdisciplinaire « Agroécologie »

Un mot :

- service écosystémique : on parle de service écosystémique lorsque les humains peuvent retirer des bénéfices à partir des ressources naturelles produites par les écosystèmes. Ces services font le lien entre un système social et un système écologique.

SYALSA : Systèmes alimentaires et santé humaine

Au cœur des relations entre agriculture, alimentation et environnement, les questions de santé peuvent être un moteur pour transformer les systèmes alimentaires. L’objectif général de SYALSA est d’identifier et d’évaluer les leviers d’action susceptibles de rendre les systèmes alimentaires plus favorables à la santé humaine, à travers l’alimentation, mais aussi à travers leurs effets sur l’environnement, en prenant en compte les co-bénéfices entre santé et environnement. Le métaprogramme vise ainsi à mieux comprendre les divers facteurs et mécanismes d’interaction qui, depuis la production agricole jusqu’à la consommation alimentaire, affectent la santé humaine. Il explore les relations entre les pratiques de production et de transformation, les expositions des populations à des contaminants environnementaux, et les impacts sur la santé. Enfin, il s’attache à caractériser, évaluer et accompagner les changements manifestes ou potentiels (innovations biotechniques, politiques publiques, comportements d’acteurs) susceptibles d’améliorer les bénéfices des systèmes alimentaires sur la santé des individus et des populations.

Lancé en janvier 2021, SYALSA mobilise les réflexions de la prospective scientifique interdisciplinaire « Nexus Santé »

L'exposome prend en compte notre exposition aux agents chimiques, présents dans notre environnement et notre alimentation, physiques avec par exemple le bruit, biologiques via les microorganismes avec lesquelles nous sommes en contact mais aussi les carences alimentaires au cours du développement et des facteurs pyscho-socio-économiques (stress, inégalités sociales).

DIGIT-BIO : Biologie numérique pour comprendre et prédire le vivant

La recherche finalisée en biologie a longtemps été guidée et nourrie par des approches disciplinaires « ciblées » : par exemple, en génétique par la caractérisation et l’étude d’un gène contrôlant un caractère d’intérêt, en toxicologie par l’étude d’effets dose-réponse négligeant les effets cocktails, ou encore en physiologie par des études centrées sur un organe et une fonction. Or, face aux grands enjeux actuels (changement climatique, préservation de la biodiversité, santé globale, sécurité alimentaire, énergie, ressources), il est nécessaire de considérer les systèmes biologiques dans leur globalité, leur diversité et leur complexité. La biologie numérique constitue une approche prometteuse pour décrypter les grandes fonctions et mécanismes du vivant, pour étudier et prédire le comportement du vivant dans des environnements multiples et fluctuants et également pour gérer les systèmes biologiques. L’objectif de DIGIT-BIO est de soutenir et développer les recherches visant à comprendre le fonctionnement et prédire le comportement des systèmes biologiques, à anticiper les impacts de différentes contraintes sur ces systèmes, à en raisonner la gestion et à disposer de leviers d’action. À moyen terme, l’ambition est de développer un petit nombre de projets de suivi in silico de systèmes biologiques en s’inspirant et en adaptant le concept de jumeau numérique.

DIGIT-BIO mobilise les réflexions de la prospective scientifique interdisciplinaire « Approches prédictives pour la biologie et l’écologie »

- La biologie numérique désigne l’ensemble des approches de recherche en biologie s’appuyant sur des données de toutes natures et sur l’usage intensif des mathématiques et de l’informatique pour les exploiter et les interpréter.

- Un jumeau numérique est une réplique numérique d'un objet, d'un processus ou d'un système qui peut être utilisé à diverses fins : améliorer les connaissances et la compréhension, guider l’expérimentation, anticiper et déterminer comment intervenir sur le systèmes…dans une vision dynamique et interactive que peut favoriser le numérique.

Un exemple : les organoïdes.

CLIMAE : Agriculture et forêt face au changement climatique, adaptation et atténuation

L’objectif de Climae est d’accompagner la transition agroécologique des systèmes agri-alimentaires et forestiers en vue de leur adaptation aux climats futurs et de leur contribution à l’atténuation des changements climatiques. Les équipes des départements de l’institut exploreront la conception et l’évaluation de tels systèmes en mobilisant l’agroécologie. Les très fortes incertitudes relatives au climat et au contexte socio-économique futur, nous conduisent à privilégier des recherches sur la transformation des systèmes de production agricole et forestière et des chaînes de valeurs associées. Ces travaux s’appuieront sur l’élaboration de scénarios régionalisés pour l’agriculture et la forêt française et les filières, à travers une opération de prospective menée avec la Direction Expertise scientifiques collective, prospectives et études d'INRAE (DEPE).

En cours de préfiguration, Climae s’inscrit dans dynamique du métaprogramme Inra « Adaptation de l’agriculture et de la forêt au changement climatique » (ACCAF) et mobilise les réflexions de la prospective scientifique interdisciplinaire « Agroécologie ».

XRISQUES : Représentation, analyse et gestion des risques et incertitudes multiples pour les systèmes alimentaires, les agroécosystèmes et les populations

De nombreux territoires, populations et écosystèmes font face à des aléas (sécheresses, inondations, tempêtes, salinisation des sols, épidémies…) et à des situations de crise, de nombre et d’ampleur grandissants. Ceux-ci sont en partie liés aux pressions que les sociétés humaines font peser sur les écosystèmes, et plus largement sur les processus assurant l’intégrité de la biosphère. Les enchaînements entre ces aléas sont plus fréquents, leurs effets se conjuguent et augmentent leur impact environnemental, social et économique, avec des conséquences bien au-delà des secteurs initialement concernés.

L’enjeu du MP XRisques est de mieux comprendre les risques multiples pesant sur les territoires et les systèmes agricoles, alimentaires et environnementaux, en particulier les risques émergents liés aux transitions rapides de ces systèmes. Il a pour objectif d’établir les connexions entre des risques de nature variée, de considérer les processus de propagation des risques en interaction, de mieux appréhender la vulnérabilité des systèmes dans leur globalité, leur diversité et leur complexité. Il vise aussi à confronter les différentes visions des risques dans la perspective de faire émerger des stratégies de prévention et de gestion ainsi que des actions et politiques publiques.

Le métaprogramme XRisques mobilise les réflexions de la prospective scientifique interdisciplinaire« Risques naturels, alimentaires et environnementaux : de l’identification à la gestion ».

Le mot :

- Multirisque : ensemble de différents aléas pouvant agir conjointement, successivement ou non, affectant des enjeux qui sont susceptibles d’être dépendants. Par exemple, la vulnérabilité d’une forêt face aux incendies accrue par des épisodes de sécheresse et/ou d’attaques de ravageurs… conjugaison qui pourrait induire un risque accru d’éboulement et concerner un territoire au-delà de la forêt.

La première génération de métaprogrammes (Inra 2010- 2018)

- Adaptation de l’agriculture et de la forêt au changement climatique (ACCAF)

En savoir plus : Dossier web & numéro spécial Pour la science

- Méta-omiques et écosystèmes microbiens (MEM)

- Gestion durable de la santé des cultures (SMACH)

En savoir plus - Gestion intégrée de la santé des animaux (GISA)

- Pratiques et comportements alimentaires (DID’IT)

En savoir plus : bilan de 9 ans de recherches

- Transitions pour la sécurité alimentaire mondiale (GLOFOODS)

En savoir plus : bilan 2020

- Gestion des services agro-écosystémiques (ECOSERV)

En savoir plus : paroles de chercheurs

- Sélection génomique (SELGEN)